Rakesh Jhunjhunwala, Warren Buffett, RK Damani, Masayoshi Son, Bill Gates, Azim Premji. Etc.

What do you think when you hear these names?

Well, for one, these are all billionaire investors or businessmen. They have amassed huge wealth for themselves. They are all operating in different industries; belong to different age groups and countries.

How in the hell did they become a billionaire?

What is common among all these extraordinarily rich investors and businessmen?

What are some of the visible characteristics?

“Success leaves clues. Go figure out what, who was successful did,

and model it. Improve it but learn their steps. They have knowledge.”

Tony Robbins.

If we want to become a billionaire, we need to first learn how all these billionaires achieved success and that’s what I plan to do with this article. There are 5 common but most important traits I have observed over the years that all these billionaires share. They are…

- Long Term Focus

- Competitive Advantage

- Position Size

- Reinvesting profits

- Little bit of Luck

Let’s look at each of them in detail.

1. Long Term focus:

“No matter how great the talent or efforts, some things take time. You can’t produce a baby in one month by getting nine women pregnant.” Warren Buffett.

Well, this is obvious right? Long term focus is an extremely important factor in their success. They always have a very longer-term view of the business and thus investments.

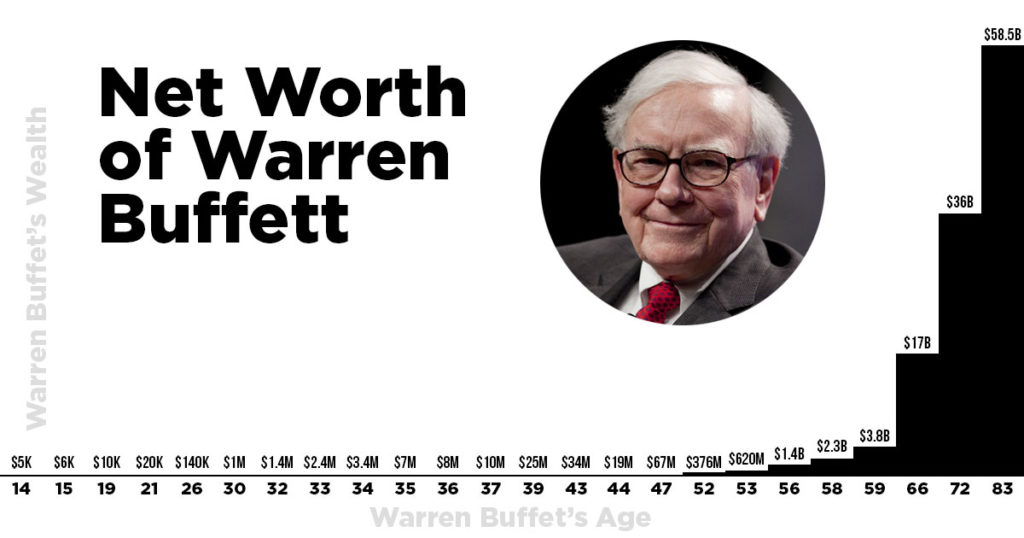

Let’s take an example of the legendary investor, Warren Buffett. He has been holding on to Berkshire Hathaway, which is the holding company of many big businesses, for more than 65 years!

Let’s take another example of our own Mr. Azim Premji of Wipro. He has been at the helm of Wipro for over 50 years. These are only a handful of examples. You can check out any investor, businessmen or companies that have created tremendous wealth over a period of very long term.

The single biggest reason is compounding. All these billionaires know that…

big money is made through compounding and compounding only works its wonders over long periods of time.

2. Intelligent Leverage:

What is intelligent leverage? Well, we are familiar with financial leverage which is borrowing money to improve your profits/ returns. This is also one of the very important factors in their success. They are able to borrow capital at highly competitive rates & use it in a disciplined way to improve their profits.

But there is another type of leverage which is often overlooked. It’s called an edge or advantage. They all have some kind of edge over competition which they constantly exploit. If you want to survive and be successful in investing/ business, you have to have some kind edge.

Let’s take an example of Apple. Why do people stand in line to pay $1000 for the phone which is not demonstrably better than the other available products? People are buying iPhone over other devices because it defines their status among peers & the feeling of owning the latest one. It’s easy to identify that someone is using an iPhone as compared to any other companies devices. That is the competitive advantage or an edge that Apple has over other phone makers.

Let’s focus our attention on financial markets. Do you have an edge to succeed in the markets?

Just think for a moment! How are you supposed to compete with the likes of professional traders, FIIs, DIIs, Mutual Funds, HFT & Algo traders who have access to fast and accurate information, data and who have billions of dollars at their disposal without some kind of an edge or advantage?

The best example is of again Mr. Warren Buffett. What’s his edge? Well, you don’t compound a large capital over 20 % CAGR for decades if you don’t have some kind of serious edge.

The Circle of Competence.

The concept of the circle of competence has been used by Buffett for years as a way to only focus on investments he knows best. He says in his 1996 shareholder letter,

What an investor needs is the ability to correctly evaluate selected businesses. Note that word “selected”: You don’t have to be an expert on every company, or even many. You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital.

The circle of competence helps you to identify your edge or advantage in any particular field or industry.

Buffett’s long-time billionaire partner Charlie Munger also echoes the same concept…

You have to figure out what your own aptitudes are. If you play games where other people have the aptitudes and you don’t, you’re going to lose. And that’s as close to certain as any prediction that you can make. You have to figure out where you’ve got an edge. And you’ve got to play within your own circle of competence.

Financial Leverage

Warren Buffett uses both types of leverage to make massive returns on his investments. While Mr. Buffett is no doubt an excellent stock picker in his circle of competence & he has got an emotional temperament which gives him an immense edge over others.

But the lesser-known factor is that he uses financial leverage in the form of an insurance float.

What that means is insurance companies collect premiums from us to provide us the safety against some future unfortunate events. Now of that large pool of people who have paid premiums, only a small percentage is going to claim the money. Remaining money can be invested in large companies with their own individual advantages.

These businesses generate more cash which is again invested and the cycle goes on. That’s how he has compounded a large pool of capital with very impressive returns.

Now leverage is a double-edged sword and many companies and investors have gone out of business because of excessive leverage. At the same time, disciplined leverage can greatly improve your returns.

The point that I am trying to make is to be successful in investing; you need both kinds of leverage.

3. Position sizing:

What does position sizing mean? It simply is how much of a stake you are holding in a company. Those who have amassed great fortunes are master at this skill. Let’s look at the below examples…

- Azim Premji of Wipro holds an almost 74 % stake in Wipro.

- Warren Buffett has all his wealth invested in his holding company, Berkshire Hathaway.

- Radhakishan Damani of D-mart retail stores holds an almost 83 % stake in his company.

- Rakesh Jhunjhunwala holds an almost 7 % stake in Titan Industries.

These are only a handful of examples but if you look at any of the billionaire investors or a businessman, they hold substantial stakes in their own companies or other companies.

Let’s take an example of Rakesh Jhunjhunwala. His net worth is over $2 billion, of which more than half is in Titan. Now imagine instead of a 7 % stake that he accumulated in Titan over the years, he only had a 0.7 % stake. Where would his wealth be at?

Peter Thiel in his book Zero to One describes this as “Power Law”. He gives an example of venture capital firm Andreessen Horowitz. They invested $250000 in Instagram which Facebook bought for $1 Billion after 2 years. Now, this seems like an excellent investment that returned 312 times of initial investment. But this return is minuscule in terms of the overall portfolio as Andreessen Horowitz had a fund of about $1.5 Billion at the time.

If they wrote check for these small amounts, they would need 19 Instagrams just to break even!

Do they use Kelly Formula?

It seems that all the billionaire investors that I have observed seem to use Kelly Formula knowingly or unknowingly.

Kelly formula was developed by John Kelly, Jr. in 1956 while working at Bell Labs. William Poundstone in his book, Fortune’s Formula describes the Kelly Formula simply as…

Edge / Odds

Where edge is how much you are expected to win on average divided by the probability of attaining the above edge.

For example, if your expected profit on a trade is, say, 25 % and your odds or probability of that gain is 60 %, then as per Kelly Formula, you should bet 41.67% (25%/60%) of your capital on that trade to maximize your portfolio gains.

Kelly Formula has attracted some of the brightest investors like Warren Buffett, Mohnish Pabrai, Bill Gross and Edward Thorp, etc.

In his book, Warren Buffett Portfolio, Robert Hagstrom says, ” We have no evidence that Buffett uses the Kelly model when allocating Berkshire Capital. But the Kelly Concept is a rational process and, to my mind, it neatly echoes Buffett’s thinking.”

Whether these billionaires specifically uses the Kelly Formula or not, you can definitely infer their thinking. They will place large bets on the investments where they have an edge & hold it for as long as that edge plays out.

It’s just not the investment that matters but the size of the investment makes all the difference.

4. Reinvesting profits:

Up till now, we saw that these billionaire investors have large stakes in the companies which have a competitive advantage and are holding for very long term.

Now, whatever profits they generate out of these investments are mostly re-invested back into the business to grow it even further which makes their wealth compound at a faster rate.

5. Luck:

Are these billionaire investors or businessmen lucky or they achieved everything by hard work and intelligence? Well, I believe, there is some element of luck in their success if not completely. Most successful investors/ businessmen have attributed their success to luck. They were there at the right place & at the right time.

Warren Buffett has often said that he won an ovarian lottery…

“My wealth has come from a combination of living in America, some lucky genes, and compound interest. [Both] my children and I won what I call ‘the ovarian lottery. I was born in the right country at the right time.”

Mark Zuckerberg who started Facebook in his dorm room at Harvard says…

“We all know we don’t succeed just by having a good idea or working hard. We succeed by being lucky, too. If I had to support my family growing up instead of having time to code, if I didn’t know I’d be fine if Facebook didn’t work out, I wouldn’t be standing here today. If we’re honest, we all know how much luck we’ve had.”

World’s richest person, Amazon founder, Jeff Bezos says that he was lucky to have started Amazon at the time all the infrastructure was already in place.

“I’ve witnessed this incredible thing happen on the internet over the last two decades. I started Amazon in my garage 24 years ago — drove packages to the post office myself. Today we have 600,000-plus people, millions and millions of customers, a very large company,”

“How did that happen in such a short period of time? It happened because we didn’t have to do any of the heavy lifting. All of the heavy-lifting infrastructure was already in place for it. There was already a telecommunication network, which became the backbone of the internet. There was already a payment system — it was called the credit card. There was already a transportation network called the US Postal Service, and Royal Mail, and Deutsche Post, all over the world, that could deliver our packages.”

Marc Cuban of Shark Tank says…

“Being a billionaire requires a lot of luck, a lot of timing.”

Does that mean we should completely rely on luck? No! You will still have to put in a lot of effort to be successful.

For example, what would you say if you won a lottery of Rs. 1 cr? Would you call it luck or effort?

Well, it’s a fact that your chances of winning a huge lottery are very less, maybe one in a million. But you still gotta buy that lottery ticket. If you didn’t buy it, then you have zero probability!

This factor is not in our control and we can’t do much about it. But our efforts are in our control.

We’ll see in some future posts how you can reduce the negative impact of luck.

Summary

These are the factors I have observed among most successful billionaire investors and businessmen over my 15 years of career in stock markets.

Will you become a billionaire reading these principles? Well, I have no way of knowing it but I can surely say that these principles will definitely guide you towards your financial freedom.

My purpose with this article was to tease out some common, visible characteristics, that according to me, helped them accumulate huge fortune for themselves.

Do you want to learn how you can apply these principles? Then sign up below to receive the free ebook, “Double Your Investment Returns.” You will learn a simple 3 step process to grow your wealth faster with less risk, less stress & less time.

Do you think there are more factors to their success apart from these? Let me know by commenting below.