The choppiness continues!

Nifty ended up 1.15% at 10739.95 on the back of stellar gains in index heavyweight Infy which rose over 9%.

During the day it was up nearly 15% but cooled off at the end of the day and took down IT Index which up over 1000 points or 6% intraday but closed up only 2.83%. All the IT stocks have traced out a shooting star pattern which shows the beginning of a correction.

Among the other sectors, Pharma & consumer stocks also witness some buying. Cipla, Dr. Reddy’s, Nestle, Britannia etc were all up!

Nifty will continue to chop around in the range of 10850 to 10550 for some time as index companies announce their quarterly results.

As long as Nifty remains above 10350, the line of least resistance is up!

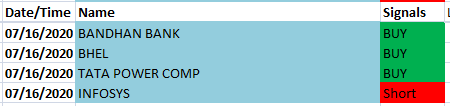

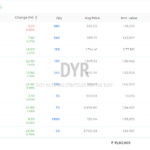

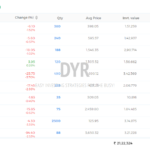

Here is the list of Most oversold & overbought stocks as per my Swing Trading System.

Have a profitable day!

Hi bro.. im prabhakaran. I have been regularly watching ur analysis in tradingview and in telegram. Im a beginner without proper learning. When i started trading two weeks ago, i bought ITC for 2,50,000 rupees. One week ago, i bought sbi bank and tata motors for 50,000 rupees each. Im holding these three stocks.

Now itc shows loss of 13k

Sbi shows 4k loss

Tata motors shows 3k loss.

Im afraid that nifty may fall down due to any bad economic condition of our nation in the coming days. So that these three stocks may go to more lower prices and loss will be more. So im planning to sell all three stocks and invest in hdfc bank and reliance with the whole money i will get from selling these three stocks.

Is it a good idea or a bad one?

If its a bad move, pls guide me..in which stocks i can invest this money to recover my loss and capital in another few days. Im on loss due my aggressive trading. Please guide me.

Hi Prabhakaran,

Thanks for writing in!

1. In my opinion, the best thing for you to do is to get out of all these stocks and pay the “tuition fees” to Mr. Market. All three stocks you mentioned are clearly in long term downtrends.

2. Don’t buy haphazardly any stock to make back the loss. Learn a good systematic investment strategy. You might wanna check out my Long Term Investment Strategy that Works!

I hope this helps…

Thanks & All the best!