Looks like Nifty is losing steam at higher levels!

Markets ended flat in an otherwise volatile but range bound day.

Among the heavyweights, Reliance, Kotak, Infy, and HCL tech were the stars of the day while Cipla, ICICI Bank, SBIN, Sun Pharma & Maruti were the drag!

Here are my observations on the the daily chart of Nifty…

- Nifty still remains overbought having closed up for 9 consecutive days.

- It has printed an Inside Bar, a Doji, and the narrowest range of the last seven days which shows that there’s going to be a big movement most likely to the downside as it’s highly stretched to the upside.

- Nifty faces overhead resistance between 12012-12071 where there’s an unfilled gap.

- Move below 11790 can take us down to 11580-11600 zone.

- Break above the upper resistance would open the doors to 12250-12430 which to me is not likely in the short term.

The outlook remains cautiously optimistic!

Nifty Bank on the other hand has already started to cool off!

Nifty Bank has failed to cross the 200 DMA and is likely going towards 23000 which would be a good buy on deeps opportunity.

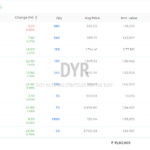

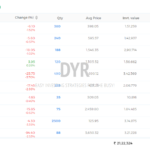

There are no signals as far as my Swing Trading Strategy is concerned. By design, any mean reversion strategy would underperform during low volatility, one-sided bullish trend. So this is expected and we stay the course!

Have a profitable day ahead!