It’s one of those Oops moments!

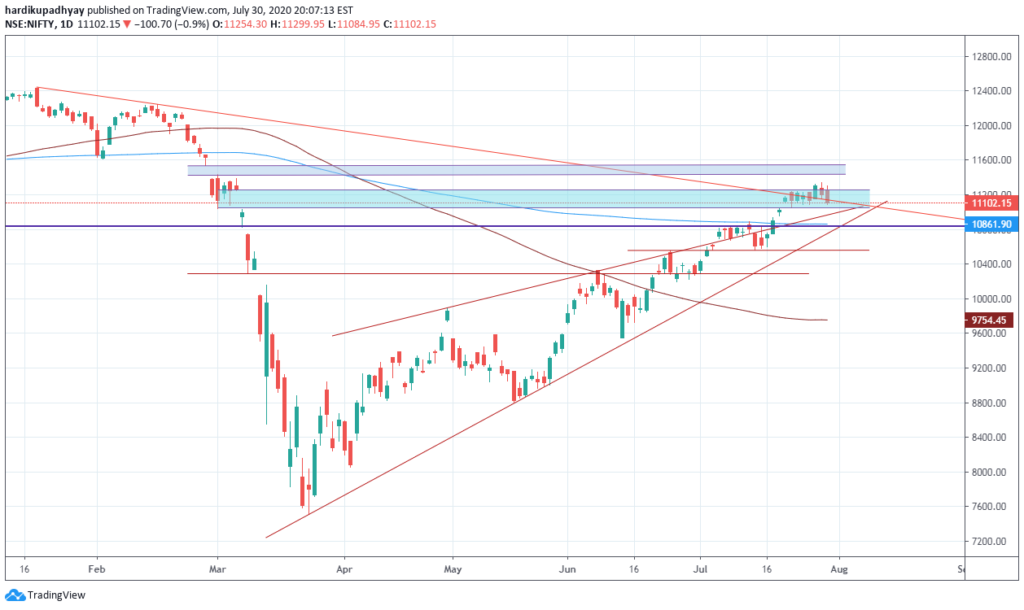

After breaking out above 5 day consolidation and downloping trendline, we were expecting Nifty to halt at 11400-11500 zone. But Nifty has given up and closed just a tad above an the lower range of the consolidation.

A break below 11050 will take us down to at least 10850 levels, which is a very crucial level for this rally to sustain.

Today’s close is also very important being the last day of the week as well as month.

I think Reliance will add fuel to the fire and take the Nifty down up to its 200 DMA.

Bank Nifty is already doing what we were expecting it to do! The major support zone remains at 21350-21000. If Nifty Bank closes in these support zones today, it will show a big shooting star on monthlies which will be very bearish for Nifty Bank.

European markets closed deep in red and the US markets closed in red except for Nasdaq which closed slightly up. Asian markets are also showing bearish to a neutral stance where Nikkei is down around 1.45%. SGX nifty is already showing a cut of 114 points.

The time is to be cautious!

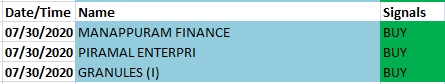

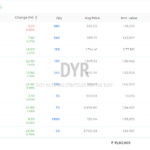

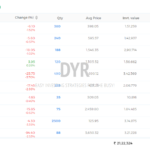

Here are the few opportunities for the day as per my Swing Trading Strategy. You can look to buy these stocks at an intraday pullback of 2-3%.

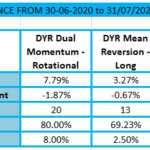

You can check out weekly real-time performance review of all my strategies.

Have a profitable day!!

Describe swing trade strategy please

Swing Trading strategy is designed to take advantage of the short term price corrections or pullbacks that happen in an ongoing bullish stock. Trades usually lasts 3-5 days. You can check out more information about the strategies here & here.