The markets continue to drift lower but not the portfolio.

The Hybrid Model Portfolio is quite resilient & just a tad lower than the all-time highs.

Hybrid Approach helps us to take advantage of both Momentum & Mean Reversion characteristics of stocks.

What I simply do is establish a core position of 10 stocks based on Dual Momentum Monthly Rotational Strategy and Scale-in and out of core positions based on my Mean Reversion Strategies so as to reduce our net costs and thus reduce risk.

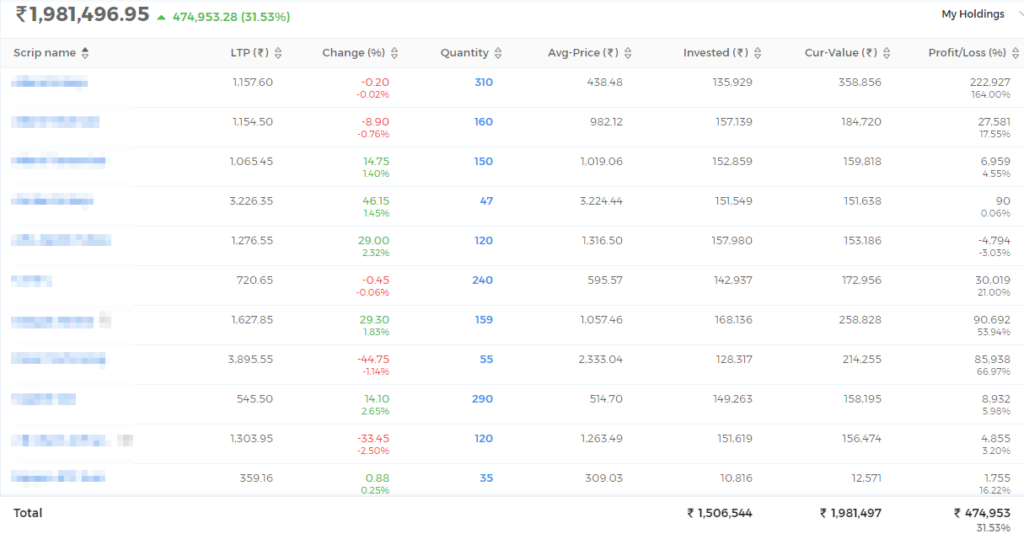

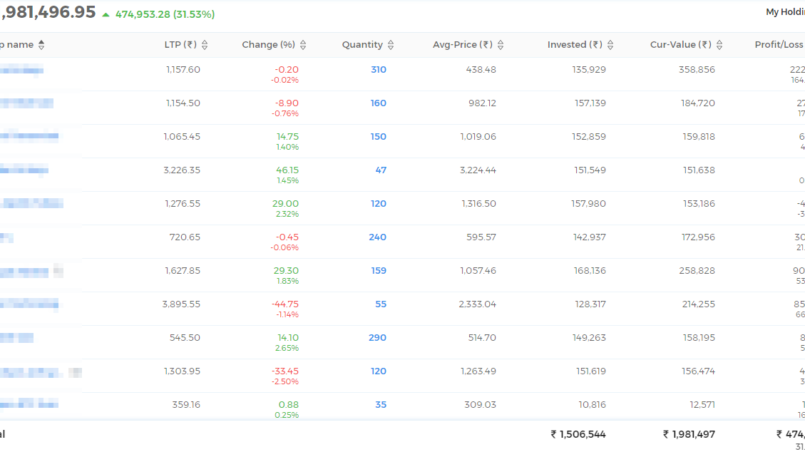

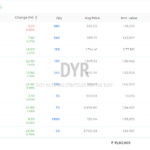

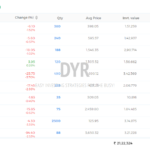

Here’s the real-time snapshot of the actual 10 stock model portfolio established based on the Hybrid Approach!

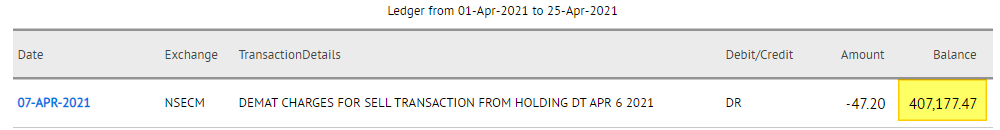

Total portfolio equity at the end of the week stands at Rs. 23,88,674.42 (19,81,496.95 + 4,07,177.47). Overall, the Hybrid Model Portfolio absolute returns stand strong at 67.04% since inception on 30/06/2020. Cash as % of the portfolio remains at around 17.05%.

The portfolio has performed very well to my expectation!

But there’s only one problem!

The Nifty has closed below its 100 Day MA for the first time since 19/06/2021.

What does that mean?

It signals the regime shift for my strategy. We use what we call a regime filter which is nothing but a risk-management tool to save us from big market declines. It alerts us to be in a capital preservation mode when markets enter a bearish phase.

As part of regime filter, we do any one of the following or both until the time Nifty is below 100 DMA!

- Avoid taking fresh positions.

- Continue to trade at a reduced position size.

The above decisions are only taken at the time of portfolio rebalance which is due on 30/04/2021.

Let’s see where we land up over the next week!

Have a great week ahead!

Fully agree NF all set to test 13600