Nifty yesterday declined by almost 200 points after kissing its 200 Day Average on Monday. The market was looking tired and the correction was much necessary.

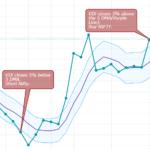

As you can see in the chart, Nifty is forming a Rising Wedge which shows that the range between the swing lows and highs is narrowing. Also, the distance between individual swing highs has reduced which shows exhaustion.

If you zoom out the chart it looks like the markets have just retraced the fall from all-time highs to March lows. Therefore it is advisable to be cautiously optimistic. The break below 10350 will confirm the downtrend again. Whether markets touch March lows or not is something we have to wait and watch.

But for now, the line of least resistance remains up!

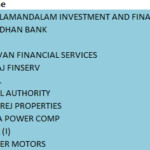

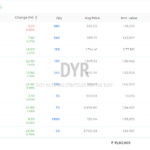

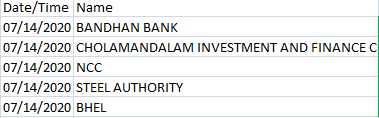

Here is a list of Most Oversold Stocks based on my Swing Trading Model. One can look to buy these stocks on further correction of 2-3% today.

*** This is not an investment advice and only for information and educational purposes.