A week that was!

This week’s market action could be attributed to Adani Group, the FED & the Dollar Index!

We’ll discuss about the Adani Group first!

It all started with this tweet by @suchetadalal on saturday,

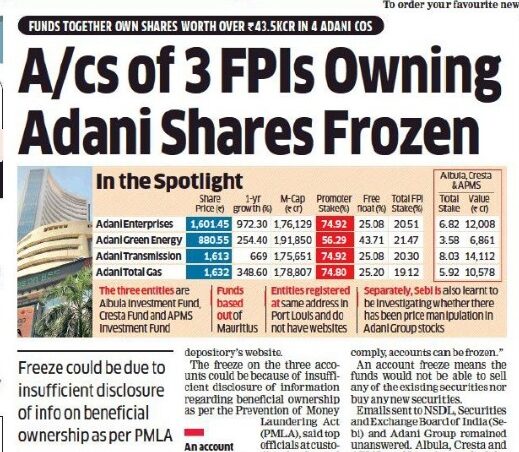

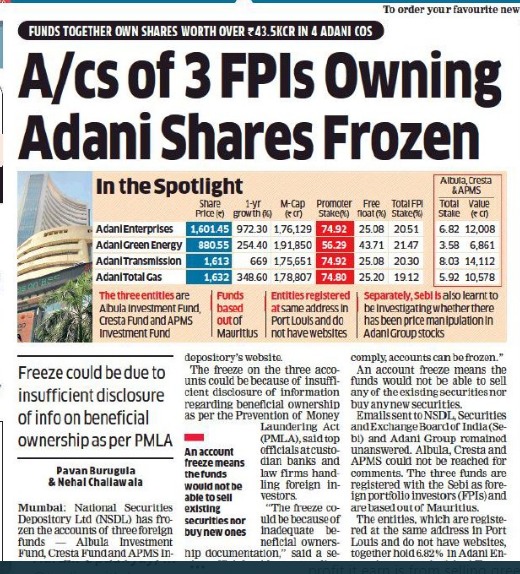

Then, on monday the Economic Times came out with news on the front page…

Not surprisingly, Adani Group shares crashed between 5-25% intraday along with the market. Later in the day, NSDL & the Adani group separately came out with statements that the accounts of the said FPIs are active!

WTF?

This incident raises a lot of doubts & suspicions not only on the group but also the publication & the NSDL!

- If the accounts were active, how come such a large publication publish the unconfirmed news?

- Why did the NSDL take so long to respond after the damage was already done?

- Is it the scandal to undermine the rise of the Adani Group? or is the Adani group really rigging the prices?

- Why did the NSE abruptly shifted Adani Group companies from normal to trade for trade segment except for AdaniEnt & Adaniports days before all this news came about?

- Why did @suchedalal tweet about the scam just around her book launch? You know, as they say, no publicity is bad publicity!

Anyways, we may never find out answers to these questions!

What’s in our hands is the risk management of our portfolios.

And as a risk management measure, I am completely out of Adani Group shares. Do check out my Performance Report for more details.

Anyways, back to markets!

Markets always give us a hint if we’re able to capitalize on it. I had warned my readers in the last week’s Market Analysis that there’s the possibility of a large correction as the top indices are diverging from each other.

Another important thing to observe is that the Sensex has also been a leading indicator of the impending corrections in the markets.

Nifty gyrated from an all-time high of 15901.6 all the way down to 15450.6 before finally settling down 0.73% at 15683.35. Nifty 500 grossly underperformed the Nifty & ended down 1.31% at 13386.55.

During the week, METALS, PSE, ENERGY, PHARMA, AUTO, BANKS lost heavily while the defensive sectors like IT & FMCG outperformed. Mid & Small-cap indices too saw heavy selling.

As I had mentioned in my previous report that the IndiaVIX is at dangerously low levels. IndiaVIX rose almost 5% for the week.

METALS & COMMODITIES especially were under pressure because of the Dollar Index…

DXY is up close to 3% for the month! The recent FED meeting concluded higher expected inflation & earlier rate hikes. Which helped commodity prices to tumble, DXY & Treasury Yields to rise!

DXY faces a significant resistance at March 21 high of 93.43.

I had hinted in my Market Analysis here that the metals index faces significant resistance at the 2008 highs. Now it looks even more daunting for them to outperform given the rise in inflation resulting in the higher Dollar.

What’s up with Nifty?

It looks very likely, given the rise in DXY & the fall in US markets on Friday, that we’ll test the demand zone between 15430-15163.

As long as we are above the rising trendline & the previous closing high, the line of least resistance remains up!

Have a great weekend!