How to pick stocks among 6000 listed stocks is a constant battle for investors!

Which stocks do you pick?

How much do you invest?

There are so many approaches to pick stocks. Which one is best for you to successfully pick stocks?

What about the risk?

These are all valid questions that make investing in share markets complex, time-consuming & risky for beginners & experienced investors alike.

I will show you a simple strategy to pick stocks that you can start to apply immediately!

But before we understand the strategy, let us first understand the different approaches to pick stocks.

Major Approaches to pick stocks:

There are three major ways to select the best stocks to invest in.

1. Fundamental Analysis:

FA analyses the company’s annual reports and other fundamental factors to derive at the fair value of the company. Then that fair value is compared with the prevailing prices and the judgment is made on whether the stock is below its intrinsic value or not. If it’s below its fair value, then the stock is considered cheap and can be considered for buying.

This is essentially called Value Investing made famous by Ben Graham & his disciple, the legendary Warren Buffett.

There’s also an approach within fundamental investing which is called Growth Investing where based on the growth of a company’s financials like earnings & topline growth, the stocks exhibiting the highest and consistent growth above the industry average are picked.

2. Technical Analysis:

Technical Analysis analyses the behavior of the stock prices, usually in the graphical form, and based on some repetitive behaviors or patterns, the judgment is made to buy or sell a stock.

In 1896, Charles Dow laid the foundation of technical analysis with the introduction of Dow Jones Industrial Average. The principles are called Dow Theory and it has stood the test of time.

Since then, numerous ways have been found to pick stocks, one of them being, Relative Strength. Relative Strength is the prominent technical study to pick stocks where one security is compared with other securities or indexes. The securities performing the best are considered for investment.

3. Quantitative Analysis:

With the advent of the latest technology, quantitative analysis has become one of the most popular ways to select stocks. Large amounts of data can be analyzed with computers and software in minutes, which will throw out some recurring patterns which can be exploited consistently. Quant analysis gave birth to Algorithmic trading where trades are executed by computer programs without human intervention.

Both of the above, fundamental & technical approaches are based on human judgment. As for the quants, it’s the data and algorithms.

Some of the biggest investors like Jim Simons or billionaire Cliff Asness of AQR rely on quantitative analysis to trade.

Which is the best approach to pick stocks among these three?

Die-hard fundamental analysts will tell you technical & quantitative analysis is a bunch of crap. On the other hand, technical & quant analysts will argue that fundamental analysis has no edge.

So what do we do?

I believe investing in stocks is the game of probabilities. The more are odds in your favor, the better are your chances of being successful.

Why not combine the positive aspects of all the above concepts and stack probabilities in our favor?

How about integrating all these approaches into one high performing strategy?

This integrated approach is generally termed as ‘Quantamental’

It’s the best of three worlds!

Now let’s learn a simple, highly effective, Quantamental strategy. It’s a 3 step simple process to identify stocks based on Quantamental.

- You don’t have to go through 1000 financial reports, charts, or other data.

- You don’t need advanced software & tools.

- You don’t have to spend hours doing the research. Just spare 30-45 minutes every month & you’re done!

How does that sound?

Too good to be true?

Let’s find out.

The Quantamental Strategy:

The objective of this simple process is to find out the top 10 or 20 stocks based on fundamental, technical & quant analysis.

Step 1: Filter Stocks on the basis of Factors:

What are the factors?

Factors answer the question of which attribute of the stock generates the outperformance in relation to broader markets.

All the stocks perform in relation to the market like the Nifty or Sensex. If the broader market rises, all the stocks will rise proportionately.

Now that proportion of the stock movement in relation to the market is measured by Beta and the stocks which generate higher returns than the market is measured by Alpha.

Noble laureate William Sharpe introduced a single factor approach in his Capital Assets Pricing Model in the 1960s. He said that any outperformance of the investors is solely the result of the market beta and not any other factors.

Later research has proved that wrong and academics have found that apart from the market beta, there are other factors like Value, Growth, Quality, Dividend Yield, Size, Low Volatility, and Momentum, etc. contribute significantly to the stock’s outperformance.

This way of investing is many times referred to as, “Smart Beta Portfolios”.

Now that we have some background on factors, the question arises.

How do we find stocks based on these factors?

I am going to share with you a little secret that very few people know 😉

What most people don’t know is that there’s a wealth of information available free on the NSE India website. There are so many indices available on the various factors we learned above.

For this exercise, we’ll choose the Nifty Multi-factor Indices and specifically, Nifty Alpha Quality Value Low-Volatility 30 Index. This index is a combination of four different factors.

If we check out the factsheet, we can see how this index has performed over a period of time. The index has generated total returns of around 16% CAGR with an annual standard deviation of around 18%. Not at all bad returns with less volatility as compared to Nifty 50.

Next, click on Index Constituents to download the list of stock forming part of the Index.

Now, what’s the catch with this ready-made index?

- The problem is that it’s a weighted index. Meaning each stock is assigned weights depending on the multiple factor values. If we want to get returns similar to index, we need to invest in exact weights which we don’t know except for the top 10 stocks.

- Another issue is we will have to constantly look for any changes in the Index. If any stock is dropped from the Index, we might have to adjust our portfolio.

Nonetheless, what we are looking for is the list of stocks that have four different factor attributes.

Out of the 30 stocks, which stock are in long term uptrends?

That’s where the Technical Analysis will be useful.

Step 2: Filter out the stocks which are in uptrends:

We will shortlist the stocks which are in long term uptrends.

How do we determine the trend?

There are many ways but for us, a simple 10 Month MA will do.

Why 10 Month MA?

It’s the monthly equivalent of the 200-day moving average. 200 Day moving average has stood the test of time in identifying the long term direction of the stock. I have already written an article on the importance of the 200 Day MA. Meb Faber of Cambria Investment has also written an excellent paper on the 10 Month MA.

It’s simple, robust & serves our purpose!

Next, open up in.tradingview.com or any other charting application that you’re comfortable using & apply the 10 Month MA and shortlist the stocks which are above the MA as shown below.

You might have to do this manually but it will not take much of your time.

Currently, there are only 6 stocks out of 30 which are above their 10 month MA as the broader market is bearish.

But what to do when more than 10 stocks are above the 10 Month MA?

That’s where relative strength will come to our rescue.

Step 3: Filter the strongest stocks:

Up until now, we shortlisted fundamentally sound stocks which are in long term uptrends. In this step, we will filter out the strongest stocks among them based on quantitative analysis.

Don’t get scared!

You will not be required to do a lot of number crunching and coding in any programming language. Simple things can work better!

If there are more opportunities than the allowed maximum positions, we can rank the stocks by dividing the current close of the stock by its 10 month MA. Rank from the highest to lowest and select the top 10.

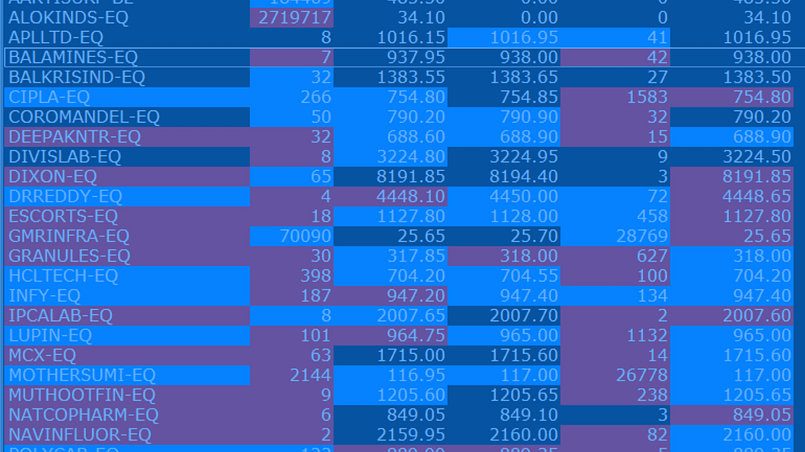

The above is the list of stocks ranked from highest to lowest in terms of close & 10 MA ratio.

By the way, the combination of Step 2 & Step 3 is famously known as Dual Momentum!

You can go ahead & invest confidently in these stocks!

Update as on 21/08/2020.

All of the above stocks have fared very well since the publication of this article.

The strategy has outperformed both the Nifty Alpha Quality Value Low-Volatility 30 Index and Nifty 50 which have gained 10.9% and 13.26% respectively since May 31, 2020.

How do you exit the stocks?

Well, there are two ways to exit the stocks.

1. Rotational Exit:

On the last day of every month, do the above exercise and exit the stocks if they are no longer in the top 10. You can also choose to exit quarterly or half-yearly. The choice is yours!

Here you will have to take one more decision. If the stock is not part of the factor indices, exit on the last day of the month.

2. Trend Following Exit:

Once you have established positions in the top 10 stocks, exit the stock only if it closes below its 10 month MA. Replace it with the top-ranked stock. Repeat every month.

Summary:

We have learned a simple investing strategy based on Quantamental which you can apply immediately. Some of the biggest firms employ these kinds of strategies to improve their returns.

If you’re looking for simple but advanced strategies like the above, do check out my strategies!

Download my free e-book, Double Your Investment Returns!

Follow my space Daily Game Plan! where I post Daily watchlist of stocks based on my strategies and update weekly real-time performance!

Some Additional Readings:

- Quantamental Investing: The Future is Now!

- A Quantitative Approach to Tactical Asset Allocation!

- Foundation in Factors: Northern Trust.

- Relative Strength Strategies for Investing by Mebane Faber.

*** This is not an investment advice and only for information and educational purposes.