Markets are on a slippery grounds!

This week saw a heightened volatility coupled with many gap ups & downs days!

As rightly mentioned in my previous piece that the Mondays have become a field day for the bears! This Monday was no different!

Nifty gapped down a little over 300 points on Monday and kept sliding down upto 14191 and recovered some lost ground by the end of the day to close at 14359.45 or 1.77% down. Nifty closed the week down 1.89% at 14341.35 while Nifty 500 ended down 1.56%. IndiaVIX rose 11% for the week.

Let’s what the charts are suggesting!

As we can see that the Nifty has closed below the all-important trendline(Red) as well as horizontal support at the previous closing peak.

Nifty has also closed below its 100 Day MA for the first time since 19/06/2020.

This doesn’t look good to me & opens the door towards January lows around 13600 or so.

I have already been cautioning my readers that the long-term charts are not so encouraging and any close below 14433.7 would be considered highly negative.

We are in the last week of April and seasonally, May is one of the most volatile months for the markets!

Results season has not started on a positive note with many IT stocks disappointing along with rising covid-19 cases, shortage of oxygen, beds & vaccines, and the breakdown of health care system are already being reflected in the prices.

Any news of lockdown extensions in some parts of the country could be bad for the economic activity.

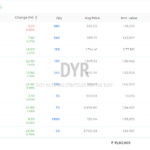

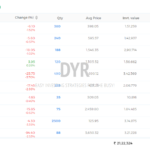

Nifty closing below 100 Day average has triggered a regime shift for my Hybrid Strategy. What this means is at the time of portfolio rebalance, if Nifty is still below the average, I would avoid any fresh positions.

Let’s see how we end the month of April next week.

Stay safe portfolio wise and health wise!