Momentum has met with mean reversion!

That’s the story of the week.

During the week, momentum stocks have suffered while the defensive, low volatility stocks have outperformed.

It’s no surprise that the Hybrid Model Portfolio also has suffered!

The Hybrid Investing Approach helps us to establish a core position of 10 stocks based on Dual Momentum Monthly Rotational Strategy and Scale-in and out of core positions based on my Mean Reversion Strategies to reduce our net costs and overall risk.

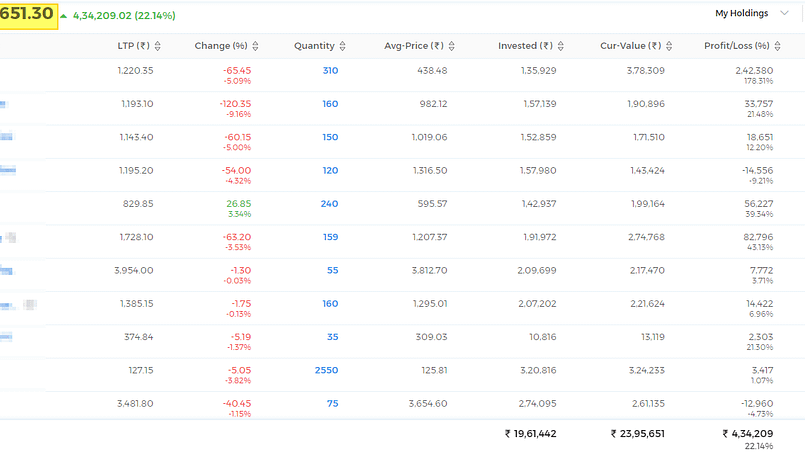

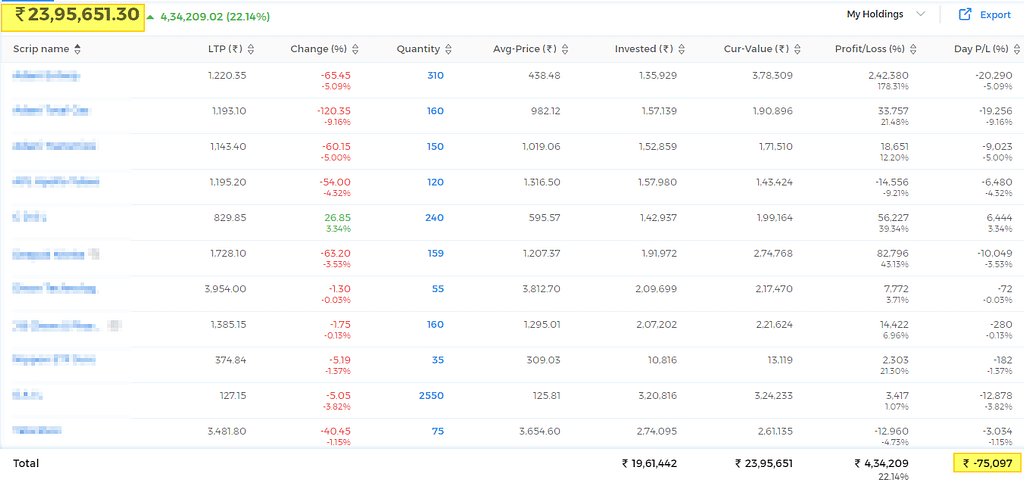

Let’s have a look at the actual 10 stock model portfolio established based on the Hybrid Investing Approach!

The total portfolio equity at the end of the week stands at Rs. 24,83,031.6 ( 23,95,651.3.45 + 87,380.3). Overall, the Hybrid Model Portfolio absolute returns stand strong at 73.64% since inception on 30/06/2020 on a total investment of Rs. 14,30,000.

This week the portfolio has corrected by almost 8.59% from the last week’s equity which is on the higher side.

Market internals is also not strong as seen in my Market Analysis this week. As we saw in last week’s Performance Review that we have around 30% exposure to metals which saw a healthy correction this week. Also out of the 10 stock portfolio, 3 stocks are of Adani Group which corrected heavily during the week.

So all in all a bad week for the portfolio!

So what should we do?

Simple! Follow the plan.

These kinds of corrections will keep on happening.

Nifty is again hovering around it’s 100 Day Moving average which in a way is a stop loss for our portfolio.

Let’s what happens over the next few weeks.

Stay safe & have a great weekend!