Markets continue its dream run!

Nifty continued its bull run this week to hit an all-time high at 12828.7 before selling at 12780.25 or up 4.21%. Its broader counterpart, the Nifty 500 also rose by 4.05% to close at all-time highs.

It’s sector rotation happening across the markets where interest-sensitive and cyclical sectors like Metals, Realty & Financials outperforming while Pharma & IT were subdued.

Our Dual Momentum Strategy Model Portfolio is still overweight on Pharma & IT. The portfolio will be rebalanced at the beginning of December 2020.

What I like about Momentum Investing is it’s natural! What I mean is whichever stocks and sectors that are outperforming, will eventually form part of the portfolio.

If, for example, Financial stocks start to significantly outperform from here on, they will surely pop-up in the momentum watchlist.

As the legendary Jesse Livermore has said…

There is only one side of the market and it is not the bull side or the bear side, but the right side.

Momentum Investing keeps us on the right side of the markets. Period.

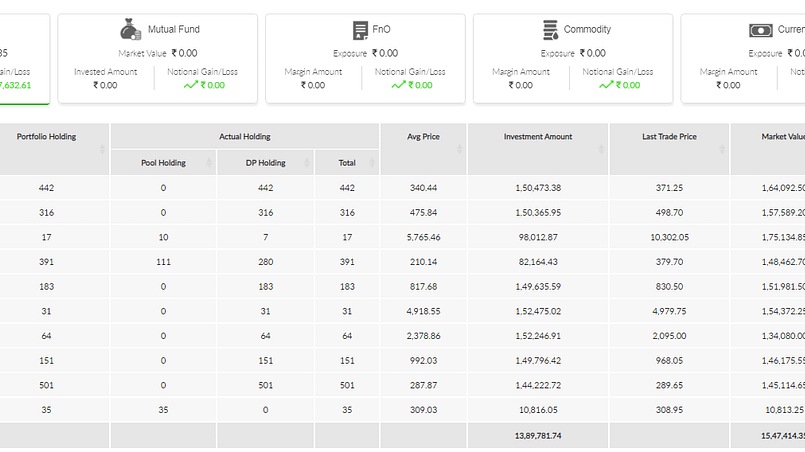

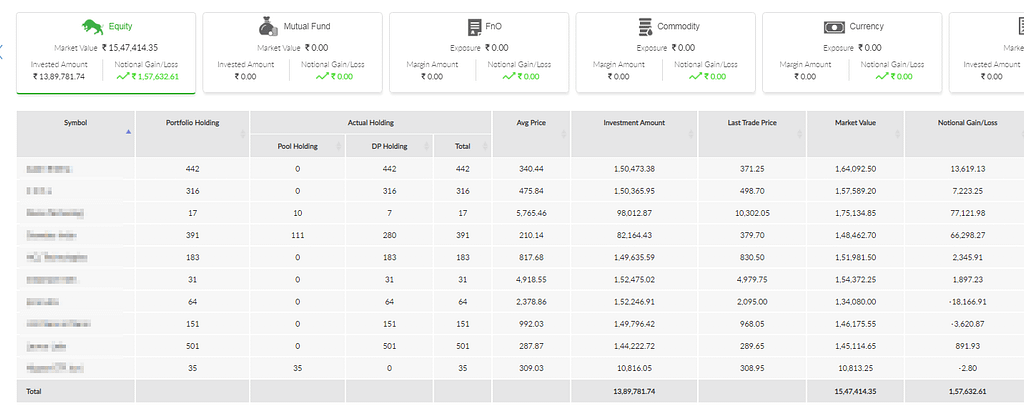

Here’s the real-time snapshot of the actual model portfolio established based on the DYR Dual Momentum Strategy.

Total portfolio equity stands at 16,75,788.04 which is slightly higher than the previous week’s equity of 16,65,010.18. The overall return of the portfolio stands strong at 21.43% since 30/06/2020.

Let’s see how the rest of November plays out!

Have a great Diwali & a profitable New Year!