The winning streak continues!

The markets have been choppy all through the week but the Hybrid Model Portfolio has made a new all-time highs.

Hybrid Approach helps us to take advantage of both Momentum & Mean Reversion characteristics of stocks.

What I simply do is establish a core position of 10 stocks based on Dual Momentum Monthly Rotational Strategy and Scale-in and out of core positions based on my Mean Reversion Strategies so as to reduce our net costs and thus reduce risk.

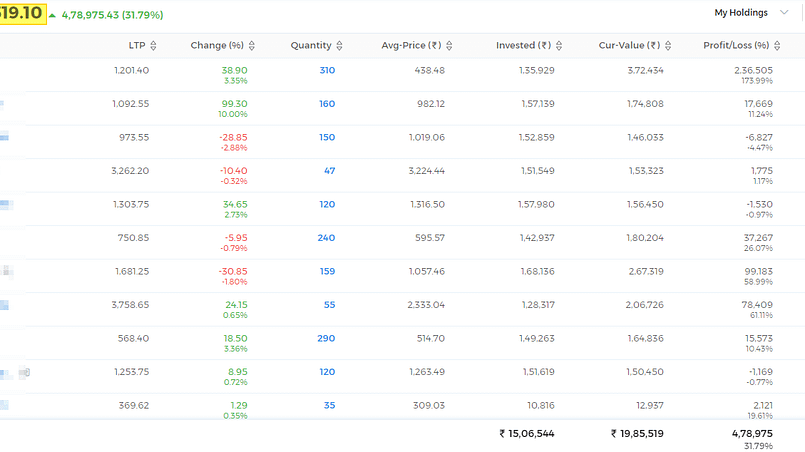

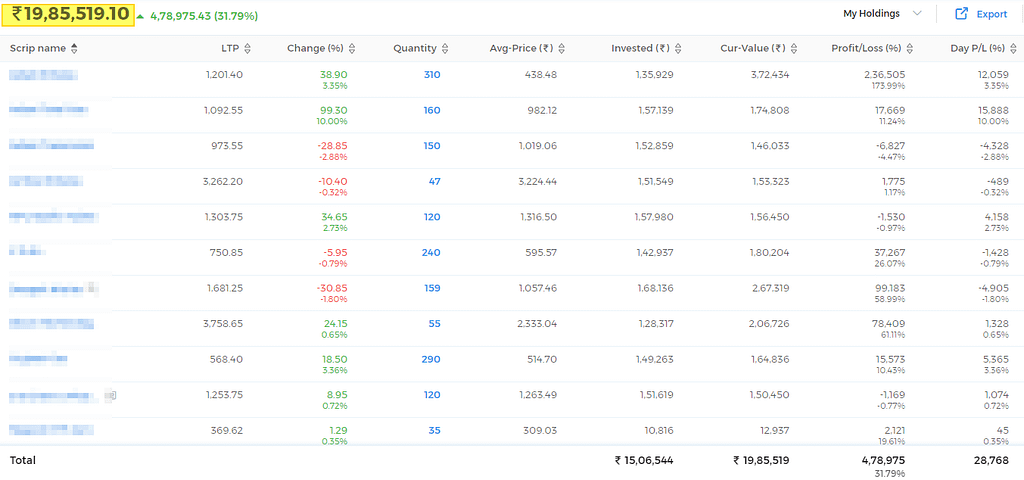

Here’s the real-time snapshot of the actual 10 stock model portfolio established based on the DYR Hybrid Strategy.

The above are real-time snapshots taken from Angel Broking backoffice.

The portfolio equity stands at an all-time high of Rs. 23,92,696.57 (19,85,519.1 + 4,07,177.47). Overall, the Hybrid Model Portfolio absolute returns stand strong at 67.37% since inception on 30/06/2020. Cash as % of the portfolio remains at around 17%.

Nifty during the same period is up by 44% while the Nifty 500 is up close to 47.82%. The Hybrid Strategy has handily beaten both the indices.

The returns are not bad for few minutes of work every day! That’s the promise of the Hybrid Approach,

Beat the market with less risk, time & stress!

Let’s see how we fare going forward!

Stay safe & have a great week ahead!