“Unless You can watch your stock holding decline by 50% without getting panic-stricken, you should not be in the stock market.”

Warren Buffett

That’s the advice coming in from the legendary investor Mr. Warren Buffett.

In his shareholder meeting a couple of years back he said that they have seen their stock fall by 50%, at least four times in their 50 years of history. We are talking about billions of dollars here!

Can an average investor digest this much of a drawdown?

Imagine you have a portfolio of Rs. 10 lakhs & it’s down by 50%. How would you feel? Terrible I suppose.

But why do people panic when in drawdown?

Obviously, no one likes to see their hard-earned money getting eroded! The average investors neither have a temperament like Mr. Warren Buffett nor do they have an edge or competitive advantage to hang on to their investments during times of distress. During those periods, hanging on to your investments is extremely painful, leave aside putting fresh money.

In my opinion, there are a couple of reasons why people panic during times of drawdown.

- You are too emotionally attached to your capital. Well, who is not right?

- Maybe because you don’t have any other source/sources of income.

- Maybe because you have taken a huge size or leverage.

- Maybe, you have invested a large portion of your wealth in equity or equity-oriented products.

- Or maybe, you don’t have any competitive advantage or edge which will make you hold on to your investment.

So, can you do something about those deadly drawdowns?

In my opinion, nothing much. Markets are supreme and they will do what they do and our job is to simply accept it. Markets will do something stupid that all your calculations and expectations will go down the drain. let me give you an example.

Since the global financial crises in 2008-2009, I have seen so many people advocate using a regime filter to reduce the overall drawdowns of the portfolio.

What’s a regime filter?

Simply stated, a regime filter alerts us when to be invested in the markets and when not to be. The logic is if the broader markets like NIFTY, SENSEX or NIFTY 500, is in an uptrend, you should be invested in the market & if the broader market is in a downtrend, you should stay out of it and park your money in some safe assets.

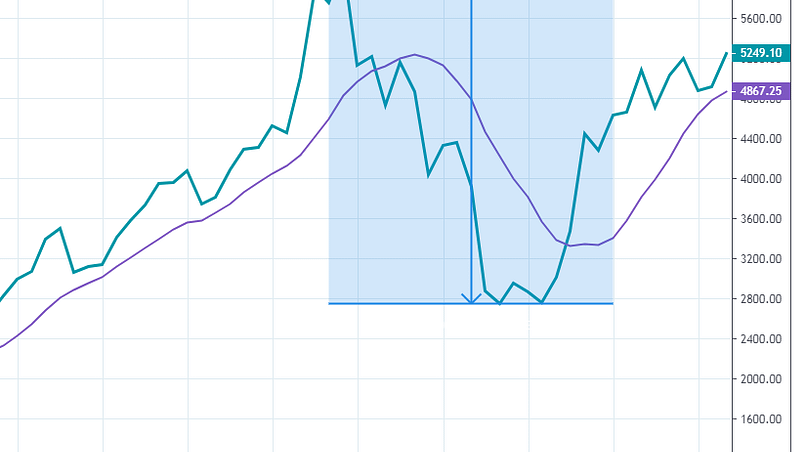

An uptrend can be defined by 10 Month MA or 200 Day Moving Average. If the market is above 200 DMA, you can invest and if it’s below 200 DMA, you shouldn’t.

Now, logically it makes sense and it can help you to reduce your risk to some extent but I have two issues with it.

- What if the market rises far above the regime filter and then corrects? An example would be again GFC of 2008-09. On 31/12/2007, Nifty closed at 6138.6 which was almost 27% above the 10 Month MA level of 4833.53. Now when the regime filter gave a bearish indication at 4734.5 in March 2008, the markets had already corrected by almost 23%. Your stock portfolio probably would have corrected more than the NIFTY.

Although, from March 2008 till October 2008, Nifty further tanked by almost 72% to 2755.2. You would definitely have avoided the rest of the bear market. But you still would have to go through a drawdown of probably greater than 30% before market regime filter gave you a switch off indication. - Another issue is the recent phenomena of polarisation. Only a few large stocks taking the market up but the broader market has not contributed. In this kind of a scenario, your regime filter will show you a bullish market but your portfolio would still be in a drawdown.

So my point is that no matter what you do, markets are going to throw up some new challenges and you just can’t escape from it. There is some truth in what Mr. Buffett says that you simply can’t avoid it.

Are there any solutions to avoid large drawdowns?

Let’s see…

- Trade short-term:

Most people day trade thinking that the risk is low. But the issue with this is if you’re looking to grow your wealth, then day trading will not help you much because it’s difficult to compound your capital. Most people confuse trading as a way to build wealth. The goal of trading is to earn an income so that you can invest for the long term to grow your wealth. - Invest in low volatility, boring stocks:

Investing in boring, low volatility & defensive stocks can shield you to some extent. These kind of stocks can provide protection against major market falls. - Diversify among different asset classes:

Diversifying your funds into different asset classes like Gold, Bonds, Equities & commodities can protect you from downside, but not always. During October 2008, correlations of many asset classes increased except for the cash. Having some cash component in your portfolio can definitely decrease major drawdown risk. - Diversify among different strategies:

Now, this is our favorite approach and our Hybrid model combines two different, mildly correlated strategies. Our long term momentum strategy buys on strength & sells on weakness while our mean reversion strategy buys on weakness and sells on strength. Both strategies are working on opposite principles and can help reduce the drawdown quite significantly. - Have multiple sources of income:

As I said earlier that if you’re emotionally attached to your capital, you will panic. You should only invest the money which you can afford to lose. You can have a capital that you can afford to lose when you have multiple sources of income.

So don’t fear that drawdown. Embrace it, accept it and you will just be fine!