The status quo remains! Markets are still stuck in a range with increased volatility! It seems Mondays are becoming a field day for the bears! Nifty on Monday opened down with a massive gap & continued to slide upto...

Category - Markets

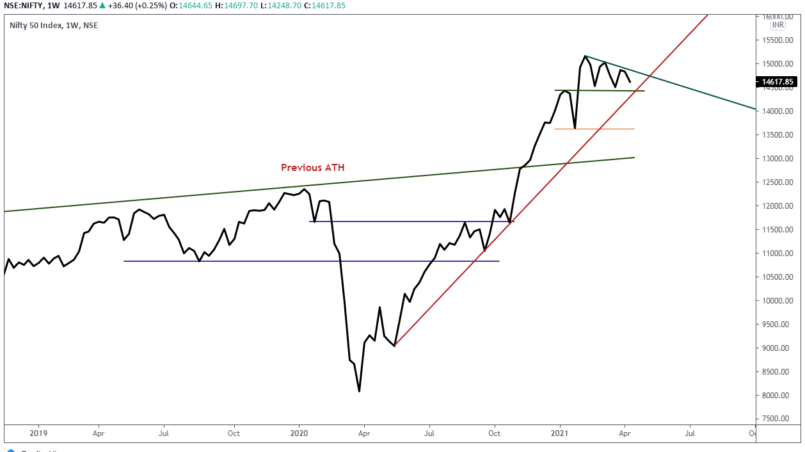

Markets continue to drift sideways! Nifty had a horrible start of the week where it tumbled more than 408 points only to recover some lost ground at the end of the day to settle at 14637.8 or down 229.55 points. By mid-week...

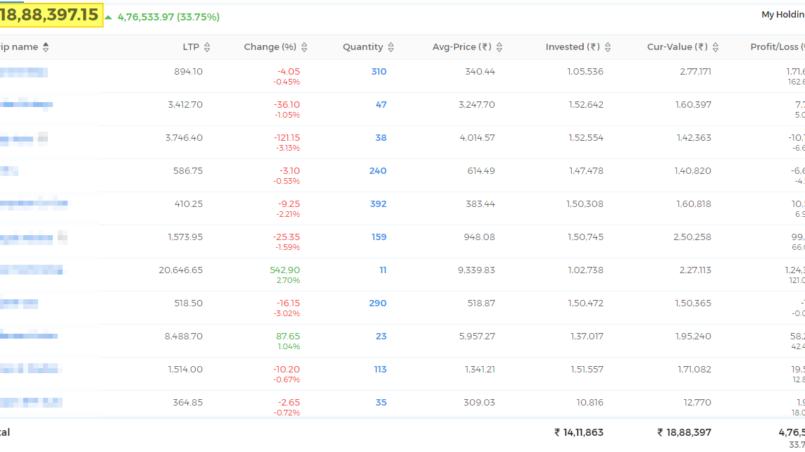

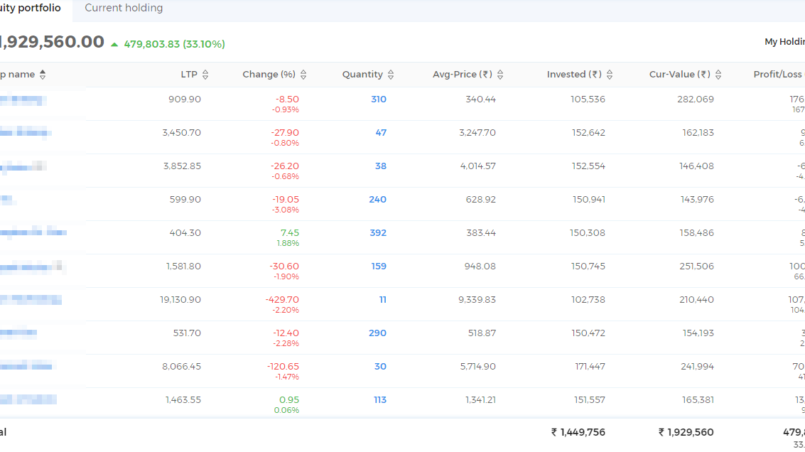

One of the best Financial Years in the recent times has ended! From April 1st, 2020 to March 31, 2021, Nifty has risen by close to 78% on a close to close basis. That’s a stellar performance in the face of the worst...

Market Outlook: The markets are on a roller coaster and so are investors! The Nifty is making a series of lower bottoms which is not at all encouraging! Every rally is getting sold into! Despite the fact that the S&P...

Market Outlook: Bulls are badly bruised but not out yet! It was a one-way street for Nifty this week. Nifty started off on a weak footing and declined all through the week. Friday saw a massive movement of 438 points where...

Market Outlook: It looks like the bulls are losing steam! Despite the struggle, the bulls have been unsuccessful in sustaining at higher levels. At the beginning of the week, Nifty slowly started recovering up to 15336.3...

Market Outlook: Markets are in consolidation mode! Nifty after the mayhem on the last Friday, had completely wiped off the losses but gave up some gains in the last two days of the week. Nifty rose 2.81% for the week...

Market outlook: Bulls have lost the grip, at least for now! Markets were all over the place during the week. I had warned my readers in the last piece of the impending correction and it just worked out exactly as...

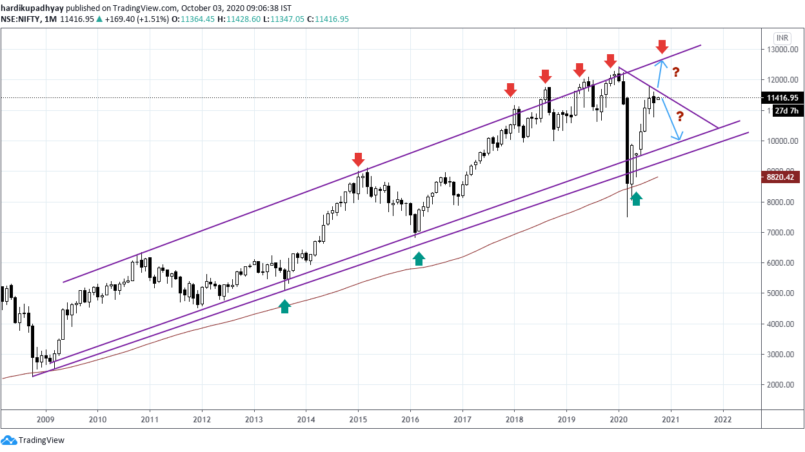

September month is over and the month of October has already started of on strong note! So what’s in store for the markets over the next few months? What are the long term charts suggesting? We get so much caught...

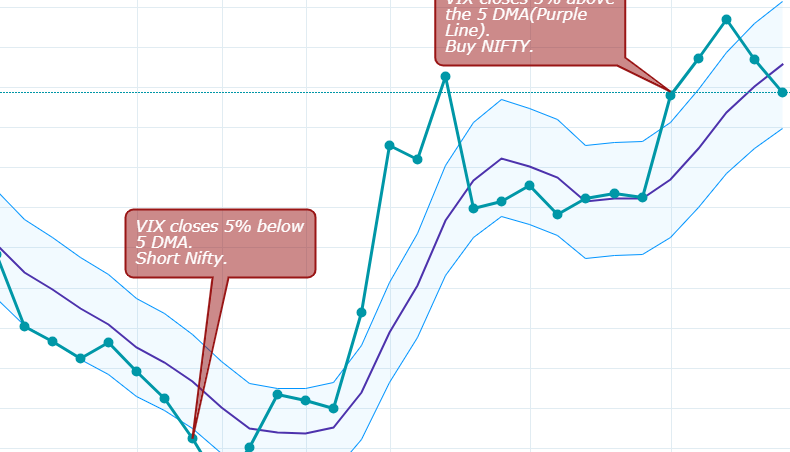

VIX VIX or the Volatility Index was started by CBOE or the Chicago Board of Trade in 1993. It was originally designed to measure the market’s expectation of the implied or expected volatility over the next 30 days on...